Save on Fees and Experience Professional Service

HOUSTON

IDEA DRIVEN VACATIONS

Search for Travel Guides, News, Events, Special Interests, and More!

-

Activities and Interests

Uncover fun activities and special interests for your upcoming trip

-

Event Travel

Plan your trip around concerts, festivals, and special events worth traveling for

-

Attractions

Explore top landmarks, scenic spots, and can't-miss local highlights

-

Travel Guides

Navigate each location like a local with our detailed travel guides

-

Travel News

Stay updated with the latest travel trends and vacation rental tips

-

Trip Ideas

Find inspiration for your next getaway with curated trip suggestions and themes

-

Travel Newsletter

Join our newsletter for exclusive travel insights, featured destinations, and trip planning tips

TRENDING

Panama City Beach Florida (PCB) Travel Guide

Panama City Beach Florida

X Games Winter Annual Event in Aspen Colorado

January -

Aspen Colorado

Stay Connected While Traveling Abroad

by Alex Sanders

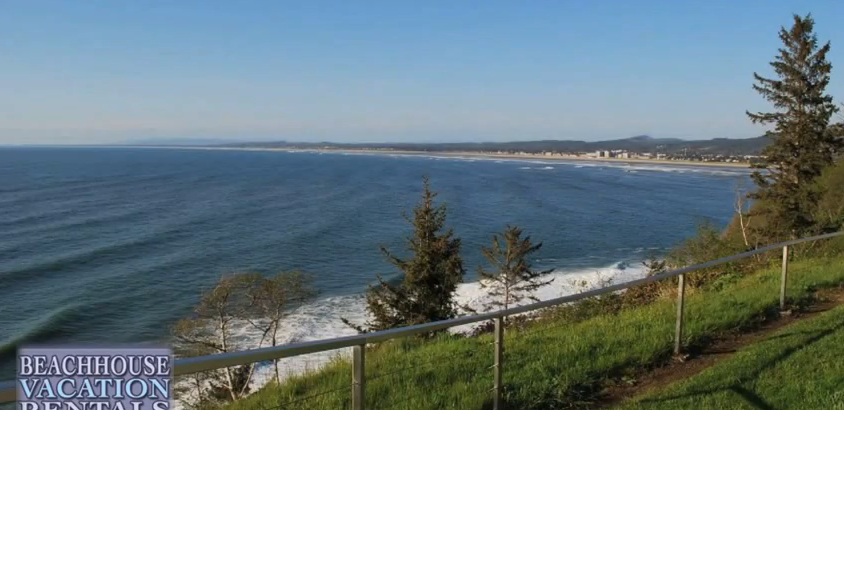

The Stormy Weather Arts Festival

November -

Cannon Beach Oregon

Ripley's Old MacDonald's Farm Mini Golf

Sevierville Tennessee

When Rental Income Falls: How to Switch to Selling Smartly

How to Pivot from Rental to Sale When Income Drops

Who doesn’t love that “ka-ching” moment from a steady rental check? But when a unit sits empty, repairs eat every payment, or the market shifts, that income can quickly become a drain. This guide walks you through how to know when rental income no longer works, how to prepare a property for sale, and practical tactics to protect your capital.

How to know when rental income no longer works

Your biggest problem isn’t the decline in income, it’s the denial that often follows. Watch for these clear warning signs:

- Properties sit empty for months and you’re paying the mortgage out of pocket.

- Every rent check is consumed by repairs, taxes, insurance, and fees.

- Net operating income (NOI) is negative or trending down repeatedly.

- Vacancies are driven by a structural market shift in your city (not just seasonal fluctuations).

Local markets behave differently: what signals liquidation in Houston could be normal seasonality in Orlando or Phoenix. Always evaluate the root cause of the drop in income.

Houston (currently) has a very stable market. And if Houston were to have a rapid increase in vacancies suddenly, that would signal a macro-level economic stress (employment shock, capital market tightening, population overflow, recession, etc.), and not trendy/passing local market noise. This would push landlords to liquidate assets and convert their properties into cash as fast as possible, which can be easily (and quickly) done by selling property to businesses that offer cash for houses in Houston.

Review the financial picture

Be ruthlessly clear about the numbers. Calculate your remaining mortgage balance, current market value, and projected carrying costs for holding the property another 6–12 months. If holding on risks depleting savings, accepting a fair offer today may be the smarter move.tthere’s more to buying vacation rentals than what’s been shown on the surface so be sure to avoid these rental property mistakes.

Handle tenants properly

If the property is occupied, follow every local law for notices and showings. Consider these options:

- Cash-for-keys: Offer a small payment to tenants who vacate cleanly and on time this can speed a sale and improve curb appeal.

- Wait out the lease: If the lease ends soon and cash flow is manageable, time the sale to minimize disruption.

- Sell occupied: Market to investors who buy properties with tenants in place (expect a lower buyer pool but faster closings).

Decide on renovations or an as-is sale

Small, cost-effective updates often give the best return: fresh paint, deep cleaning, minor landscaping, and updated fixtures. If the home needs major repairs, an as-is sale to an investor or cash buyer avoids large upfront costs and long timelines.

Practical checklist before listing

- Get a quick market valuation or comparative market analysis (CMA).

- Estimate closing costs, agent fees, and outstanding liens.

- Document property condition: take photos and note repairs.

- Ensure compliance with tenant laws or secure written agreements for showings and move-out.

- Decide whether to target retail buyers (higher price, longer close) or investor/cash buyers (faster close, lower price).

Conclusion

Markets move like nature they are unpredictable and outside your control. Your job as an investor is to react in ways that preserve capital and minimize losses. By monitoring NOI, understanding local market drivers, treating tenants fairly, and choosing the right sale strategy, you can convert a draining rental into a stable outcome and reclaim your time (and vacation days).

Frequently asked questions

When should I sell my rental property?

Consider selling if vacancies are prolonged, NOI is negative consistently, or if you face structural market shifts that threaten long-term returns.

Can I sell a property with tenants in it?

Yes. You can sell occupied properties but follow local notice laws, consider cash-for-keys to encourage a clean vacancy, or market to investors who buy with tenants in place.

Additional Find Rentals Articles

The Best 10 Travel Books Worth Reading

by Joshua Robinson

Outer Banks Annual Events and Festivals

Outer Banks North Carolina

Annual Three Oaks Flag Day Celebration

June -

Northern Michigan