Save on Fees and Experience Professional Service

FLORIDA

IDEA DRIVEN VACATIONS

Search for Travel Guides, News, Events, Special Interests, and More!

-

Activities and Interests

Uncover fun activities and special interests for your upcoming trip

-

Event Travel

Plan your trip around concerts, festivals, and special events worth traveling for

-

Attractions

Explore top landmarks, scenic spots, and can't-miss local highlights

-

Travel Guides

Navigate each location like a local with our detailed travel guides

-

Travel News

Stay updated with the latest travel trends and vacation rental tips

-

Trip Ideas

Find inspiration for your next getaway with curated trip suggestions and themes

-

Travel Newsletter

Join our newsletter for exclusive travel insights, featured destinations, and trip planning tips

TRENDING

Wedding Vacation Rentals

by Find Rentals

Williamson Realty Client Overview | Find Rentals Case Study

Ocean Isle Beach North Carolina

Furnishing your Vacation Rental Property

by Kelly Reed

Sanibel Island Florida Travel Guide

Captiva and Sanibel Lee Island Coast Florida

How to Make the Most of Investing in Florida Real Estate

When you read or hear about Florida, you tend to imagine beautiful and calm seashores, upscale cities with a mix of metro charm and a sunny laid-back vibe, and of course, the booming and highly profitable real estate business. You would be right on all counts and to top it all, many Hollywood celebrities and corporate magnates including Dwayne “The Rock” Johnson and Larry Ellison are cashing in on the area.

Such surging demands for properties in the Sunshine State should not come as a surprise since this is one of the fastest-growing states in the U.S. with a population increase of 1.4% per year in Florida the last 10 years. Given this report, should you join the wave and snag your slice of Florida real estate? The answer is yes, but only if you know how to invest in the area wisely, which brings us to our first focus.

What Should You Lookout for in Florida Property Investment Markets?

Making a killing of the real estate market in Florida is easier said than done, even with the bullish sentiments for the industry. But there are a few factors you can consider while hunting to increase your chances of success, such as:

Long-Term Property Value and Proximity to Amenities

As with all investments, one has to think long-term when eyeing a property in Florida. The industry is quite sound and varied, there’s no doubt about that, however, it’s always good to know where it’s going and what trends and new developments are being established. These can mean different things to successful investors and the assets they control.

For example, they might see a growing demand for housing in the Southwest region as an excellent opportunity to invest in new condos, as they are a safe bet. So, look for areas where property values have steadily risen over the years. Properties close to amenities like schools, shopping centers, parks, and public transportation command a higher value and appeal, as they make it easier for buyers to commute.

Vacation Rentals and Waterfront Properties

Florida is a top tourist destination with millions of visitors year-round, most of whom are willing to pay top dollar for Florida vacation rentals, especially fancy ones with amenities and prime locations, like beachfront homes or condos with ocean views. These places often command higher rental rates and stay booked, especially during peak seasons like spring break and summer.

Areas like Dustin, Clearwater Beach, and Key West are hot spots for vacation rentals because of their gorgeous beaches and attractions. But remember, they are high-value markets, so do your homework before jumping in.

Areas with Weather Hazards

Florida typically sports a sunny and warm climate; however, most of its regions occasionally experience hazards like hurricanes, flooding, and tornadoes, known to destroy or severely damage properties as was witnessed in Hurricane Irma in 2017. So, in your best interest, look into any potential history of natural disasters in your location of choice.

Coastal regions get hit by hurricanes more often, which calls for you to check if the location is marked as a flood zone and what kind of insurance you may need. Likewise, consider properties with hurricane-resistant features to protect your investment by limiting damage and of necessity, appeal to even the most cautious buyer or renter.

Financing Options for Your Investment

Houses in Florida cost an average of $400,000; but in places like Key West, a single-family home may rise north of $1 million. Just as you may expect, saving up that kind of money can take ages and be quite difficult for most people, especially for such a high-value area.

To overcome this challenge, consider exploring traditional mortgages, private financing, or even hard money loans, depending on your financial strength and investment goals. With low interest rates or better terms at your disposal, your target property becomes more affordable and rewarding.

Portfolio Goals and Their Alignment with Your Choice Property

Every investor has different goals, be it cash flow through rental income, property appreciation, or diversification of assets. Think about what you want out of investing in a Florida property. Then, see how it fits into your overall investment strategy, so it doesn’t overshadow or hinder it. Your portfolio can take many forms.

For instance, if you’re gunning for a steady rental income, focus on properties in high-demand rental areas. On the other hand, if you prefer long-term appreciation, check out emerging neighborhoods with growth potential.

Hiring an Experienced Investment Team

Navigating Florida’s housing market is no walk in the park which makes having the right people in your corner crucial; you’ll need real estate agents who know the local markets inside out, property managers who can handle rentals smoothly, and financial advisors with good investment track record to help you make informed decisions and maximize your investment potential.

What Cities in Florida are Highly Desirable for Property Investments?

With the tips above, you’re ready to start searching for properties in Florida. To help narrow down your search, we’ve highlighted the top five cities with the most potential in terms of demand, scenery, a strong job market, and diverse amenities.

Miami

First up is Miami, a major international hub with a fast-growing economy, rich culture, and strong

tourist sector. Here, property valuations have seen a significant upturn in the past decade, with homes typically listing for $589,900 and renting for $2,068 on average.

Notably, Miami is a melting pot of multicultural communities, each propped with unique investment opportunities: luxury condos, pocket-friendly rental units, industrial spaces, you name it. Some of the hottest deals you’ll come across lie in Brickell, Wynwood, Coconut Grove, Downtown Miami, and a few other neighborhoods.

Orlando

This city is famous for Disney World and Universal Studios. But there's more to it than just theme parks. Orlando boasts a strong presence in tech and healthcare. As a result, it attracts a diverse set of professionals from both industries and beyond, contributing to the city’s dynamic housing market that mostly comprises long-term rentals and vacation homes.

Properties here typically sell for $395,000, while the average rent is $1,713 per month; investment-wise, the most sought-after locations are Lake Nona, Downtown Orlando, Winter Park, and Kissimmee.

Tampa

Tampa has a good employment opportunity due to its economy which is already diversifying in fields such as finance, health, and technology. The attractive features of the city include waterfront locations and vibrant business districts thus the fact that more than fifteen major companies have their headquarters in this city with five of them being on the Fortune 500 list.

The average price of a home here is $430,000, though it costs around $1,651 to rent a place. Some of the areas that are ideal for investment are Channel District, Ybor City, Hyde Park, and West Riverfront.

Jacksonville

Due to its rapid development, Jacksonville is one of the young cities in Florida and its cost of living is relatively cheaper than other big cities. The city has a great employment opportunity and even more affordable housing than Tampa.

Home sales here are estimated at $321,000 and rent, at $1,455, making it an ideal city for long-term investment, especially in Riverside, San Marco, Downtown Jacksonville, Southside, and a few other neighborhoods.

Fort Lauderdale

This city is renowned for its boat canals and beautiful beaches and remains a top go-to destination for luxury real estate and seasonal rentals. Located near Miami, it’s a plus for businesses and professionals who, on average, pay $635,000 to purchase a property or $2,900 per month to rent one. And with communities like Las Olas, Victoria Park, and Tarpon River, you can tap into this robust housing market and earn decent returns.

Conclusion

If you’re looking to make your first real estate investment in Florida, you are on track, considering the perks of such an undertaking. However, don’t jumpstart the process without doing due diligence. Review the guidelines covered so far and seek expert opinion as needed. That way, you’ll be able to make the right call.

Additional Find Rentals Articles

Daytona Blues Festival

October -

Daytona Beach Florida

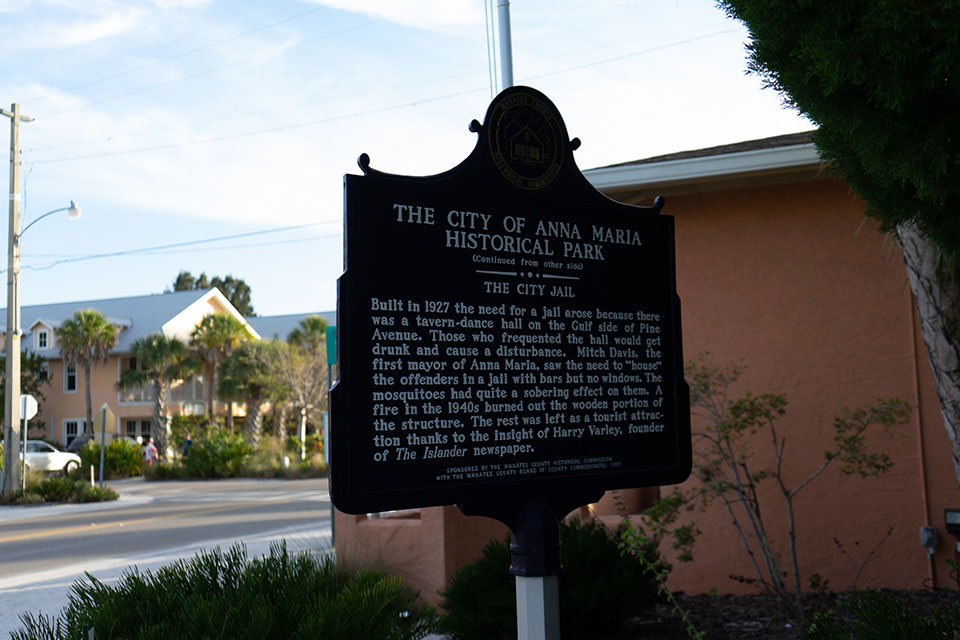

The Anna Maria Island Historical Society

Anna Maria Island Florida

Telluride Colorado Mushroom Festival

August -

Telluride Colorado